Maybe you’ve been considering reducing some of your application costs in 2017 by adding a new Apache sprayer. If so, it might be smart to make your purchase before the end of the year. Why? Because you can take advantage of Section 179 tax deductions that make the purchase of your new Apache even more appealing.

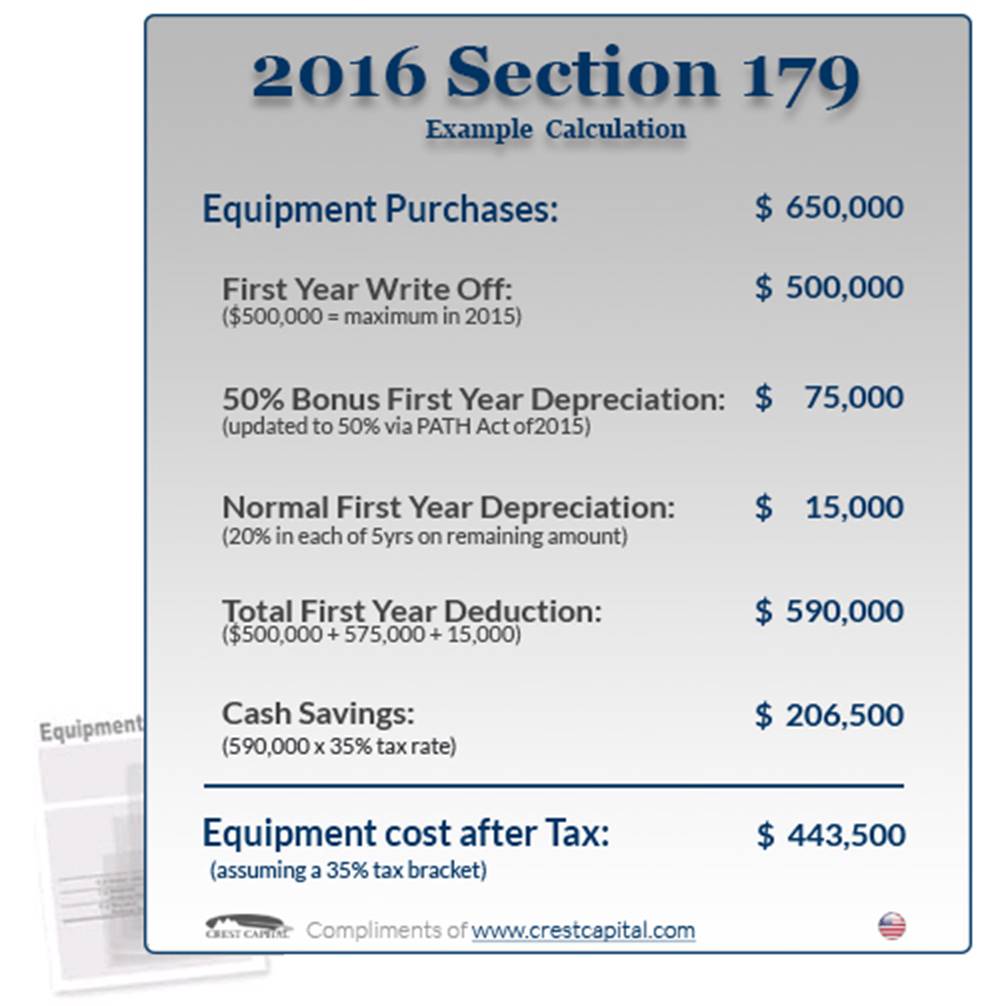

Section 179 deductions allow farmers to deduct up to $500,000 on the purchase of capital expenses (like a new Apache sprayer). As few as two years ago, the deduction limit was just $25,000, so this is an opportunity to enjoy significant tax savings. Additionally, stack savings that are still available on brand new Tier 3 engine Apache models and still low equipment financing interest rates. This makes the time between now and December 31 a very smart time to buy your new Apache!

Stop by your local dealer before January 1 to learn more. They can even show you an ROI calculator that will help you see the real financial advantages owning a new Apache.

In addition to taking advantage of this gift from the government, be aware that interest rates are on the rise. Did you know that 10 year US Treasuries have risen from 1.8% to 2.4% since the election? Buy now before rates climb higher.

Did you know some leases also qualify as purchases for Section 179? Check out our 2017 AS 1220 +2 (popularly equipped model) which can be leased for around $26,000 per year.